Comparable Companies Analysis

A comparable companies analysis is always used in company valuations and is a relative valuation method. The method indicates the value of similar companies in relation to different key ratios that is later compared to your business. Common key ratios in a comparable company valuation are: EV/EBITDA and EV/SALES.

1. Select the universe of comparable companies

To start with, you should try find stock-listed companies that are similar to the company you wish to estimate value on. This group of companies are called “peer group”. If you have difficulties finding such companies, try to find companies that are affected by the same external effects such as your company. For example, if you are producing windows and cannot find a listed window manufacturer, try to find companies that manufactures real estates. A listed real estate company has almost the same customers as a window producer, and are affected by changes in the economy and consumer behavior in similar ways.

Look for companies in your region and size! If you run a US company, choose companies listed in the US. If you run a global company, choose companies that also have business in several countries. If you run a small company, choose small companies and so on.

If you have followed this step by step tutorial this far, and enjoyed it, I would very much appreciate if you could help me promote this website by clicking the google and Facebook symbols below to recommend this site to others:

[fb-like-button]

2. Locate the necesserary financial information

If you have a database such as Bloomberg or Reuters, this step is easy. If you do not have access to these types of resources, you will have to look in annual reports, search on google, read analyses and sector reports – to gather your data. What you should look for are Valuation measures and forecasts. List your list of companies in excel to get a good overview (see our example below).

3. Spread key statistics, ratios and trading multiples

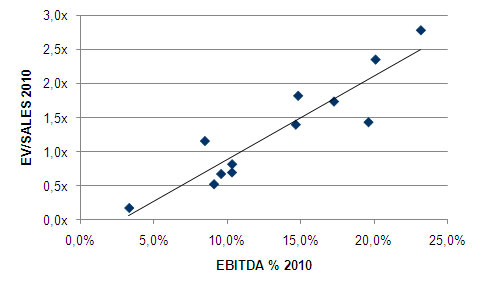

Now analyse your peer group and calculate key multiples. Commonly used multiples are EV/EBITDA, EV/SALES and growth rates.

4. Benchmark the comparable companies

5. Determine valuation in this comparable company valuation

Use the key financial numbers from the company you wish to value. For example, if your company is predicted to have sale of 100 million in 2010, this would imply an Enterprise Value of 130 million (1.3 x 100) in our example. If your company is predicted to make an EBITDA of 10 million for 2010, this implies an Enterprise Value of 83 million (8.3 x 10).

The valuation range for this company is therefore in the range: 83 – 130 million!

I will do my best to help you quick

I will do my best to help you quick

I will gladly help you with any question you might have. Either comment below the relevant content or send me an email or use my contact form which can be found here.

Specialities: Business valuations, Excel models, Business development, Investment Banking, Buyouts, Divestments, Share issues, IPOs, Management Buyouts, Leveraged Buyouts.

Have a great day! (thanks for sharing my website which helps my content available to more users)

Hi,

I know that EV/EBITBA is a good way for business valuation, but I’m wondering why should we use the EV/SALES when do the valuation?

I’m just a student and sorry to bother you, thanks~

Hi,

I was wondering about the author’s conclusion on the final Enterprise Value. According to this article, the range value is situated between [83 – 100]. To me it should be [83 -130].

Please, correct me if I am wrong.

Regards

Thana, good spotted 😉

The number of 8.3 for EBITDA was reached by ?

I believe given the numbers, it should be 8.9?

Can’t seem to make 8.3 with numbers there.

Thanks for your comment M. 8,3 is the median EV/EBITDA for all the peers 2008 in table. If you multiply your targets EBITDA with the median, you get the EV for the company you are doing the comps valuation of. Please let me know if its unclear or if you need more help (or if I misunderstood your question).

Hi.. ITC is a conglomerate in India with about 65% of sales accounted for by their cigg business and the balance coming from a range of businesses including hotels, paper and paper boards, FMCG- food, personal care, retail, IT and so on.

I have been trying to figure out what would be a good comparative company for ITC. HUL- unilever india- is close in terms of sales volume, however its a FMCG pure play; other tobacco companies in India have relatively far lower sales figures..

sum of the parts is prob the way to undertake a valuation but what in your opinion would be the best comparables/how would you suggest i go about doing a comparables analysis?

thnks!

Pooja,

I am not familiar with ITC. But in general a SOTP valuation (sum of the parts valuation) is the best method for conglomerates. SOTP is the answer to your question as you already mentioned.

If you have limited time to perform your analysis, choose a peer group within the industry that ITC has most of its business in. When presenting the valuation however, you must argue for the peer group that you have choosen, its weaknesses etc.

Sometimes a trading comps valuation is not the best valuation approach, a combination of several methods is the way to do it.

Good luck!

Hi, I want to value http://www.pagalguy.com. I searched your article on net. This seems to be a helpful article but I’m not able to follow the method properly. can you please send an excel sheet which you posted as an image for my reference. I hope to understand things better from the excel sheet.

-Thanks

Ankit

Hi Ankit,

What you see on the picture is simple a list of values received from a database (Bloomberg, Thomson or similar). These values are summed up by using the median formula in Excel “=MEDIAN()” and the average formula “AVERAGE=()”.

You can use the median or the average values to apply the same multiples on the company you wish to value. I do not know anything about the company you are mentioning, but I assume it is pretty small. In that case you will also need to adjust/discount the value with a small company size premium.